We’ve gathered many resources to help protect you – and for you to help protect yourself. Check out our security tips to help enhance your protection in the physical and digital worlds.

ONLINE BANKING SECURITY TIPS

At Waterford Bank, N.A., we use leading-edge technology to ensure that all customer information is safe, but security is a team effort and you can help keep your information secure by practicing safe internet usage. Follow these steps to help protect yourself and add an extra layer of protection to your online experience.

Make Sure You’re on the Right Site

To help ensure you’re on the real Waterford Bank, N.A. as you sign in, check your browser address bar for:

- www.waterfordbankna.com

- Green text/shading

- Lock icons

Encryption

We protect our customers by using a combination of security measures that are among the best in the e-commerce industry.

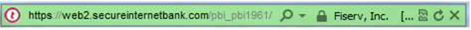

Online Banking

We are committed to making your online banking experience secure and protected. When you log in to Online Banking, you should see the web address (URL) bar turn green and, depending on which browser you are using, you should see “Fiserv, Inc” either before or after the web address. Seeing these visual clues tells you that you are at a valid website and it is OK to log on.

In addition to what you can see with the green bar, our Online Banking site is validating you as a user behind the scenes. Your browser, computer, operating system and other identifiable items on your PC are being compared to what you have used before to log on. If these do not match, you will be asked to answer your security questions, just as you have before when logging on to a new PC.

Website Security

Waterford Bank, N.A. uses leading firewall and network security technology to protect our computer systems from unauthorized access.

You can be confident that your personal information is safe and private during and after you complete our online transactions. If you have any questions or concerns regarding the security of your information or these security tips, please contact us.

PRIVACY POLICY

IDENTITY THEFT PROTECTION

Identity theft is one of the fastest-growing types of fraud with up to 500,000 cases each year. These tips are part of Waterford Bank, N.A.’s continuing efforts to promote financial education and safety. Identity theft involves criminals stealing individuals’ personal credit information and assuming their identities by applying for credit in their names, running up huge bills, stiffing creditors and generally wrecking victims’ credit histories.

Vigilant monitoring of your personal information and knowing who you are doing business with are two of the best ways to avoid becoming a victim. Understanding how criminals get access to your personal information is your first line of defense.

Consumers can avoid becoming victims by following some simple security tips from the American Bankers Association:

- Don’t give your Social Security number or other personal credit information about yourself to anyone who calls you. Criminals use this information to open new charge accounts posing as you.

- Tear up receipts, bank statements and unused credit card offers before throwing them away. Shred these documents if you have a shredder available. Criminals can collect bits of information about you by going through your trash.

- Watch for missing mail and don’t mail bills from your own mailbox with the flag up. An identity thief may steal your mail and file a change of address form with your credit card company or the U.S. Postal Service.

- Review your monthly accounts regularly for any unauthorized charges.

- Order copies of your credit report once a year to ensure accuracy.

- When conducting business online, make sure your browser’s padlock or key icon is active.

- Don’t open email from unknown sources and use virus detection software.

- Protect your PINs and passwords and change them frequently.

- When logging on to the online banking system, make sure that YOUR picture and pass phrase appear on the screen before entering your password.

- Report any suspected fraud to your bank, credit card companies and the fraud units of the three credit reporting agencies immediately.

Manage Your Mailbox

- Do not leave bill payment envelopes clipped to your mailbox or inside with the flag up; criminals may steal your mail and change your address.

- Know your billing cycles, and watch for any missing mail. Follow up with creditors if bills or new cards do not arrive on time. An identity thief may have filed a change of address request in your name with the creditor or the post office.

- Carefully review your monthly accounts, credit card statements and utility bills (including cellular telephone bills) for unauthorized charges as soon as you receive them. If you suspect unauthorized use, contact the provider’s customer service and fraud departments immediately.

- When you order new checks, ask when you can expect delivery. If your mailbox is not secure, then ask to pick up the checks instead of having them delivered to your home.

- Although many consumers appreciate the convenience and customer service of general direct mail, some prefer not to receive offers of pre-approved financing or credit. To “opt out” of receiving such offers, call 888-5-OPTOUT sponsored by the three credit bureaus.

- The Direct Marketing Association offers services to help reduce the number of mail and telephone solicitations. To join its mail preference service, mail your name, home address and signature to Mail Preference Service, Direct Marketing Association, P.O. Box 9008, Farmingdale, NY 11735-9008.

Check Your Purse or Wallet

- Never leave your purse or wallet unattended – even for a minute.

- Protect your PINs (don’t carry them in your wallet!) and passwords; use a 10-digit combination of letters and numbers for your passwords and change them periodically.

- Carry only personal identification and credit cards you actually need in your purse or wallet. If your ID or credit card is lost or stolen, notify creditors immediately, and ask the credit bureaus to place a fraud alert in your file.

- Keep a list of all your credit cards and bank accounts along with their account numbers, expiration dates and credit limits, as well as the telephone numbers of customer service and fraud departments. Store this list in a safe place.

- If your state uses your Social Security number as your driver’s license number, ask to substitute another number.

Keep Your Personal Numbers Safe and Secure

- When creating passwords and PINs (personal identification numbers) do not use any part of your Social Security number, birth date, middle name, spouse’s name, child’s name, pet’s name, mother’s maiden name, address, consecutive numbers or anything that a thief could easily deduce or discover.

- Ask businesses to substitute a secret alpha-numeric code as a password instead of your mother’s maiden name.

- Shield the keypad when using ATMs or when placing calling card calls.

- Memorize your passwords and PINs; never keep them in your wallet, purse, Rolodex or electronic organizer.

- Get your Social Security number out of circulation and release it only when necessary; for example, on tax forms and employment records, or for banking, stock and property transactions.

- Do not have your Social Security number printed on your checks, and do not allow merchants to write your Social Security number on your checks. If a business requests your Social Security number, ask to use an alternate number.

- Never give your Social Security number, account numbers or personal credit information to anyone who calls you.

Bank, Shop and Spend Wisely

- Store personal information in a safe place and shred or tear up documents you don’t need. Destroy charge receipts, copies of credit applications, insurance forms, bank checks and statements, expired charge cards and credit offers you get in the mail before you put them out in the trash.

- Cancel your unused credit cards so their account numbers will not appear on your credit report.

- When you fill out a loan or credit application, be sure the business either shreds these applications or stores them in locked files.

- Tear up receipts, bank statements and unused pre-approved credit card offers and convenience checks before throwing them away.

- When possible, watch your credit card as the merchant completes the transaction.

- Use credit cards that have your photo and signature on the front.

- Sign your credit cards immediately upon receipt.

- Carefully consider what information you want placed in the residence telephone book and ask yourself what it reveals about you.

- Keep track of credit card, debit card and ATM receipts. Never throw them in a public trash container. Tear them up or shred them at home when you no longer need them.

- Ask businesses what their privacy policies are and how they will use your information. Can you choose to keep it confidential? Do they restrict access to data?

- Choose to do business with companies you know are reputable, particularly online.

- When conducting business online, use a secure browser that encrypts or scrambles purchase information and make sure your browser’s padlock or key icon is active.

- Don’t open email from unknown sources. Use virus detection software.

Review Your Information

- Order a copy of your credit report from the three credit reporting agencies every year and make sure all the information is correct, especially your name, address and Social Security number. Look for indications of fraud, such as unauthorized applications, unfamiliar credit accounts, credit inquiries, and defaults and delinquencies you did not cause.

- Check your Social Security Earnings and Benefits statement once each year to make sure that no one else is using your Social Security number for employment.

Important Contact Information

- Federal Trade Commission ID Theft Hotline: 1-877-438-4338

- Equifax: 1-800-685-5000

- Experian: 1-888-397-3742

- TransUnion: 1-877-322-8228

As always, you can contact us if you have any questions or concerns.

STEPS TO TAKE IF YOU ARE A VICTIM OF IDENTITY THEFT

If you suspect misuse of your personal information to commit fraud, take action immediately. Keep a record of all conversations and correspondence when you take the following suggested steps:

- Contact your bank(s) and credit card issuer(s) immediately so the following can be done:

- Access to your accounts can be protected; stop payments are made on missing checks; personal identification numbers (PINs) and online banking passwords are changed; and a new account is opened, if appropriate.

- Be sure to indicate to the bank or card issuer all of the accounts and/or cards potentially impacted, including ATM cards, check (debit) cards and credit cards. Customer service or fraud prevention telephone numbers can generally be found on your monthly statements.

- Contact the major check verification companies to request they notify retailers using their databases not to accept these stolen checks, or ask your bank to notify the check verification service with which it does business. Three of the check verification companies that accept reports of check fraud directly from consumers are:

- Telecheck: 1-800-710-9898

- International Check Services: 1-800-631-9656

- Equifax: 1-800-685-5000

- File a police report with your local police department. Obtain a police report number with the date, time, police department, location and police officer taking the report. The police report may initiate an investigation into the loss with the goal of identifying, arresting and prosecuting the offender and possibly recovering your lost items. The police report will be helpful when clarifying to creditors that your are a victim of identity theft.

- Contact the three major credit bureaus and request a copy of your credit report.

- Review your reports to make sure additional fraudulent accounts have not been opened in your name or unauthorized changes made to your existing accounts. Check the section of your report that lists “Inquiries.”

- Request the inquiries be removed from your report from the companies that opened the fraudulent accounts. In a few months, order new copies of your reports to verify your corrections and changes to make sure no new fraudulent activity has occurred.

- Request a fraud alert for your file and a victim’s statement asking creditors to call you before opening new accounts or changing your existing ones. This can help prevent an identity thief from opening additional accounts in your name.

- Check your mailbox for stolen mail. Make sure no one has requested an unauthorized address change, title change, PIN change or ordered new cards or checks to be sent to another address. If a thief has stolen your mail to get credit cards, bank and credit card statements, pre-screened credit offers or tax information, or if an identity thief has falsified change-of-address forms, that’s a crime. Contact your local post office and police.

- Maintain a written chronology of what happened, what was lost and the steps you took to report the incident to the various agencies, banks and firms impacted. Be sure to record the date, time, contact telephone numbers, person you talked to and any relevant report or reference number and instructions.

Important Contact Information

- Federal Trade Commission ID Theft Hotline: 1-877-438-4338

- Equifax: 1-800-685-5000

- Experian: 1-888-397-3742

- TransUnion: 1-877-322-8228

As always, you can contact us if you have any questions about these security tips or concerns for your information.

CYBER SECURITY TIPS

Malicious cyber activity affects individuals in a variety of ways, ranging from malware and scams to cyber bullying. Fortunately, there are a few simple steps you can take to help keep you, your kids, and your devices protected from the latest threats.

Here are some cyber security tips for enhancing safety:

- Keep Software Up-to-Date. Be sure to keep the operating system, browser software, and apps fully updated with patches. Even new machines can have out-of-date software that leaves you at risk. Operating systems and applications are constantly being updated to fix bugs and address security issues. You should use automatic updates to ensure you’re using the most secure version of the software that is available. Also, review the privacy settings – when an app is updated, it may change your settings!

- Configure Your Device and Apps with Security in Mind. The “out-of-the-box” configurations of many devices and apps are default settings often geared more toward ease-of-use than security or protecting your information. Enable security settings on your device, and as you install software and apps, pay particular attention to those that control information sharing.

- Malware Protection. Make sure to have antivirus with anti-phishing support installed on all devices (desktops, laptops, tablets, etc.). Set it to update automatically and run virus scans at periodically.

- Consider Comprehensive Internet Security. Consider using a comprehensive Internet security software in order to better keep your device safe. Most Internet security software suites offer parental controls, which are great for managing applications that can be downloaded and the time spent on the device, while making sure students are communicating with friends on social networks in a safe way.

- Practice Safe Computer Usage. Use trusted apps and only browse to trusted websites. Malware is often hidden in apps that trick you into downloading them or in fake websites that lure you in with interesting pictures or stories! Make sure everyone who uses the device takes the same precautions.

- Think Before Sharing. It’s easy to over share online. Be careful about divulging personal information – like school names, team names, home addresses, and telephone numbers.

- Be a Smart Network User. Don’t access personal or financial information over unsecured public WiFi networks such as the free WiFi in coffee shops, bookstores, hotels, and schools, as this data can be easily viewed by others. Instead, consider using your smartphone’s more secure cellular signal to surf the Web, and if you have other devices, “tether” them to your phone instead of using an open and unsecured WiFi.

- Be on Guard for Phishing. Don’t open email attachments from suspicious sources. You may be expecting emails from group members or teachers, but use caution when opening any attachments. If you are not expecting an email or it just doesn’t look right, don’t open it. It could be a phishing attempt.

- Use Strong Passwords. To ensure a strong password, make sure you use a complex and unique password for each account/system. Use passwords that are at least 10 characters long, and contain upper and lowercase letters, numbers and symbols.

- Guard Against Physical Access. A key problem for students continues to be the general lack of privacy and personal space they have at school. Whether it’s a shared living space, crowded work space, or the general communal environment of a college campus, they’re constantly exposing their devices to access by others. Be aware of your surroundings and keep your computing devices with you or locked in a safe place.

- Backup Your Data. Saving important data is important given the growing risk of “ransomware” infections. Ransomware is a type of malware that locks up a person’s files until the victim pays a ransom to the hacker. It is prudent to back up often, using both a physical storage device like a flash drive or external hard drive and a cloud-based account.

- Don’t Jailbreak/Root Your Device. Jail breaking a device is when you gain “root” access to the device, which means that you disable the manufacturer and operating system protections so that you can access areas you were not intended to have access to. This can reduce the security on the device, making it more likely that you will be infected with malware. Jail breaking your device puts you at a greater risk of getting hacked, and makes the device more susceptible to malware, malicious apps and sensitive information disclosure. It is best not to jailbreak your devices.

FRAUD PREVENTION TIPS

General Tips

- Never give out financial or personal information about yourself to anyone via the telephone, email or any other method of communication when you don’t know with whom you are dealing.

- Every home should have a shredder; do NOT throw financial or personal documents (bank statements, income tax returns, ATM receipts, for example) in the garbage, but rather ensure that they are shredded.

- Review your credit report at least once a year, looking for suspicious or unknown transactions. You can get a free credit report once a year from each of the three major credit bureaus at www.annualcreditreport.com. Use a different agency at three different times during the year so that you are continually monitoring your credit history.

- Equifax: 1-800-685-5000 or www.equifax.com

- Experian: 1-888-397-3742 or www.experian.com

- TransUnion: 1-877-322-8228 or www.transunion.com

- Always remember: If it sounds too good to be true, it probably is.

Online Transactions and Email

- Be wary of suspicious emails. Never open attachments, click on links or respond to emails from suspicious or unknown senders. Remember, neither financial institutions nor businesses will send you unsolicited emails asking you to supply your account or password information.

- Avoid downloading programs from unknown sources.

- Do not use your Social Security number or any account number as a username or password. Change your passwords regularly and use combinations of letters, numbers and “special characters.”

- Use secure websites for transactions and shopping. Make sure Internet purchases are secured with encryption to protect your account information. Look for “secure transaction” symbols like a lock symbol in the lower right-hand corner of your web browser window, or https:// in the address bar of the website. The “s” indicates “secured” and means the web page uses encryption.

- Always log off from any website after making a purchase with your credit or debit card. If you cannot log off, shut down your browser to prevent unauthorized access to your account information.

- Keep your computer operating system and web browser up-to-date to ensure the highest level of protection.

- Install, run and keep antivirus software updated.

- Turn your computer off completely when you are finished using it – don’t leave it in sleep mode.

- Conduct online banking activities on secure computers only. Public computers (computers at Internet cafes, copy centers, etc.) should be used with caution, due to shared use and possible tampering. Online banking activities and viewing or downloading documents (statements, etc.) should only be conducted on a computer you know to be safe and secure.

Debit and Credit Cards

- Do not send your card or account number through email, as it is typically not secure.

- Do not give out your card number over the phone unless you initiated the call.

- When selecting a personal identification number (PIN), don’t use any number or word that appears in your wallet (such as name, birth date or phone number).

- Memorize your PIN. Don’t write it down anywhere, especially on your card, and never share it with anyone.

As always, you can contact us if you have any questions about these security tips or other fraud prevention measures.

MOBILE DEVICE SECURITY TIPS

As consumer use of mobile devices continues to climb, cyber criminals are targeting those gadgets more frequently. According to a report by the Federal Reserve, 52 percent of smartphone users say they have used mobile banking in the past 12 months. In recognition of National Consumer Protection Week March 6 – 12, Waterford Bank, N.A. is highlighting 12 ways consumers can take extra precaution to protect the data on their mobile device.

“We use various safeguards to protect customer information, but it’s also important for users to keep safety measures in place on their end to prevent sensitive data from being compromised,” said Cathy Martin, SVP & CIO at Waterford. “It’s easy to forget that your mobile device can be vulnerable, but any device used to connect to the Internet is at risk.”

Waterford Bank, N.A.suggests following these 12 steps to help protect your mobile device:

- Use the pass code lock on your smartphone and other devices. This will make it more difficult for thieves to access your information if your device is lost or stolen.

- Log out completely when you finish a mobile banking session.

- Protect your phone from viruses and malicious software, or malware, just like you do for your computer by installing mobile security software.

- Use caution when downloading apps. Apps can contain malicious software, worms, and viruses. Beware of apps that ask for unnecessary “permissions.”

- Download the updates for your phone and mobile apps.

- Avoid storing sensitive information like passwords or a social security number on your mobile device.

- Tell your financial institution immediately if you change your phone number or lose your mobile device.

- Be aware of shoulder surfers. The most basic form of information theft is observation. Be aware of your surroundings especially when you’re punching in sensitive information.

- Wipe your mobile device before you donate, sell or trade it using specialized software or using the manufacturer’s recommended technique. Some software allows you to wipe your device remotely if it is lost or stolen.

- Beware of mobile phishing. Avoid opening links and attachments in emails and texts, especially from senders you don’t know. And be wary of ads (not from your security provider) claiming that your device is infected.

- Watch out for public Wi-Fi. Public connections aren’t very secure, so don’t perform banking transactions on a public network. If you need to access your account, try disabling the Wi-Fi and switching to your mobile network.

- Report any suspected fraud to your bank immediately. You can reach us at 419-720-3900, from our contact page, or by visiting us in office.

BUSINESS EMAIL COMPROMISE

Cyber Criminals are always looking for new ways to steal your information. The FBI warns the latest scheme criminals are employing is Business Email Compromise (BEC).

Business Email Compromise (BEC) is defined as a sophisticated scam targeting businesses working with foreign suppliers and/or businesses that regularly perform wire transfer payments. The scam is carried out by compromising legitimate business e-mail accounts through social engineering or computer intrusion techniques to conduct unauthorized transfers of funds.

Technical Details

The victims of the BEC scam range from small businesses to large corporations. The victims continue to deal in a wide variety of goods and services, indicating a specific sector does not seem to be targeted.

It is largely unknown how victims are selected; however, the subjects monitor and study their selected victims using social engineering techniques prior to initiating the BEC scam. The subjects are able to accurately identify the individuals and protocols necessary to perform wire transfers within a specific business environment. Victims may also first receive “phishing” e-mails requesting additional details regarding the business or individual being targeted (name, travel dates, etc.).

Threat

Most of these BEC incidents involved the compromise of an email account belonging to a CEO/CFO and the subsequent use of that account to email wire transfer instructions to an employee with the ability to conduct wire transfers.

The FBI tracked a total of 44 fraudulent wire transfers provided through victim reporting that occurred as a result of BEC between 9 December 2015 and 9 March 2016 totaling $75,657,487. The wire transfers averaged approximately $1.7 million, and the largest attempted wire transfer was over $19.8 million.

Defense

The following precautionary measures as provided by the FBI’s IC3 may help prevent falling victim to BEC schemes. Though these steps are aimed at enhancing your security there is no 100% guarantee that they will protect you from BEC:

- Avoid free web-based e-mail accounts: Establish a company domain name and use it to establish company e-mail accounts in lieu of free, web-based accounts.

- Be careful what is posted to social media and company websites, especially employee names and email addresses, job duties/descriptions, hierarchical information, and out of office details.

- Be suspicious of requests for secrecy or pressure to take action quickly.

- Consider additional IT and financial security procedures especially for any kind of financial transaction , including the implementation of a 2-step verification process. For example –

- Out of Band Communication: Establish other communication channels, such as telephone calls, to verify significant transactions. Arrange this second-factor authentication early in the

relationship and outside the e-mail environment to avoid interception by a hacker. - Digital Signatures: Both entities on each side of a transaction should utilize digital signatures. This will not work with web-based e-mail accounts.

- Delete Spam: Immediately report and delete unsolicited e-mail (spam) from unknown parties. DO NOT open spam e-mail, click on links in the e-mail, or open attachments. These often

contain malware that will give subjects access to your computer system. - Forward vs. Reply: Do not use the “Reply” option to respond to any business e-mails. Instead, use the “Forward” option and either type in the correct e-mail address or select it from the

e-mail address book to ensure the intended recipient’s correct e-mail address is used. - Consider implementing Two Factor Authentication (TFA) for corporate e-mail accounts. TFA mitigates the threat of a subject gaining access to an employee’s e-mail account through a

compromised password by requiring two pieces of information to login: something you know (a password) and something you have (such as a dynamic PIN or code).

- Out of Band Communication: Establish other communication channels, such as telephone calls, to verify significant transactions. Arrange this second-factor authentication early in the

What To Do If You Are a Victim

If funds are transferred to a criminal account, it is important to act quickly:

- Contact your financial institution immediately upon discovering the fraudulent transfer.

- Request that your financial institution contact the corresponding financial institution where the fraudulent transfer was sent.

- Contact your local FBI office. The FBI, working with the United States Department of Treasury Financial Crimes Enforcement Network (FinCEN), might be able to help return or freeze the funds.

- File a complaint, regardless of dollar loss, with www.bec.ic3.gov

-The information provided is from the FBI’s Internet Crime Complaint Center (IC3)

Need More Information?

Feel free to reach out to us, or sign up for our periodic newsletter to stay up to date with all the latest Waterford Bank N.A. news and alerts.