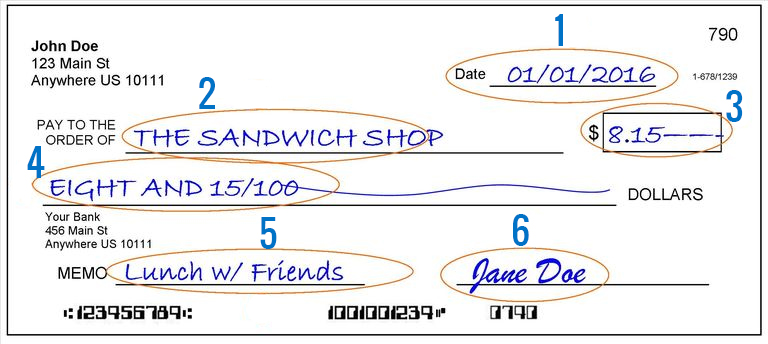

Writing checks used to be a habit for many people. But with debit cards, online banking and mobile payments, it’s now a bit of a lost art. If you need help with how to write a check, follow these 6 simple steps:

1. Include the date. This goes on the line in the top right corner of the check. If you’re in the U.S., write it as month-date-year.

2. Name the recipient. Who will receive the check? You can name a person or a business.

3. Fill in the amount with numerals. This is the easy part. Just write out in numbers how much you owe in this box.

4. Write out the amount in words. Add a dash or use a fraction, like 15/100, after you write the amount in words so the recipient can’t add money. Keep in mind that the written line is the legal line – if there is a discrepancy between the written line and the numbers box (step 3), the written amount is the amount that will be used.

5. Say what it’s for. This part is optional but handy. It helps you remember why you wrote the check.

6. Sign your name. Your check will be rejected if you don’t sign it.

Have more questions? Check out these FAQs.

Q: What should I do if I make a mistake?

A: If it’s a minor slip-up, draw a single line through the word and rewrite it. Otherwise, invalidate the check by writing “void” across it in large letters. You might be asked for a voided check when setting up direct deposit with a new employer.

Q: What is a post-dated check?

A: A post-dated check has a future date written on it. For instance, if you’re mailing your December rent check on Nov. 28 but won’t have the necessary funds until the first of the month, you might date the check Dec. 1. However, post-dating checks is not recommended. The bank doesn’t have to honor that later date, and overdraft or non-sufficient funds fees may apply if you don’t have the money to cover it.

Q: Why do some people write lines on their checks when the amount is even?

A: As a security measure, you can draw a straight line through the empty space that follows the written-out dollar amount. That way, fraudsters can’t add numbers to make the check worth more than you intended.

Q: Can I write a check to myself?

A: Yes, you can do so by naming yourself as the recipient. That’s one way to move money from one bank account to another. Either deposit the check at your new bank or use its mobile check-deposit service, if it has one.

If you want to cash a check at a bank or credit union branch, write “cash” in the check’s memo section. Be sure to have a valid, government-issued photo ID.

Now that you’ve gotten a refresher on how to write a check, take some time to compare your account to the best checking accounts on the market. You might find that it’s time for a change.

-Tony Armstrong is a staff writer at NerdWallet, a personal finance website.