Mary Pohlman, Treasury Management Portfolio Manager Officer

In Waterford Bank’s Treasury Management Department, your safety and convenience are our top concerns. That’s why we offer fraud protection tools that provide top of the line security with minimal effort from your business. Learn how you can save time and money with Positive Pay and ACH filters.

Here’s how they work.

What is Positive Pay?

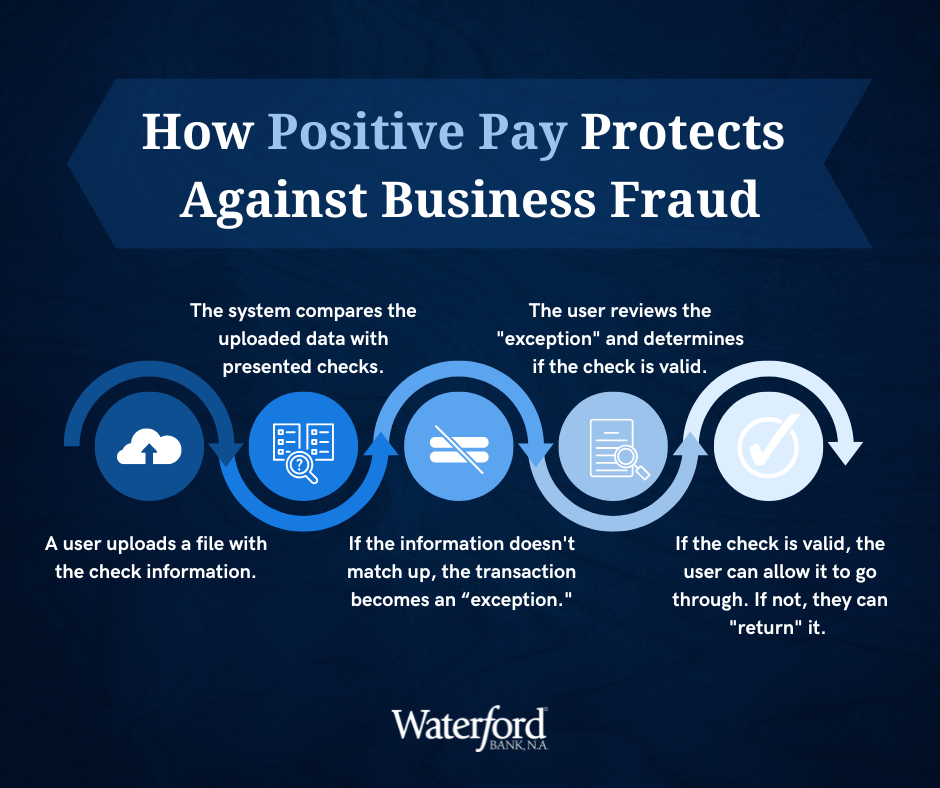

Check Positive Pay is an automated tool that flags potential fraud by matching the issued payee, dollar amount, and check number of a payment with a list of previously authorized checks.

Waterford clients are simply able to upload a file that provides all the required information from each check issued. The system then compares that data with the check presented to look for any discrepancies.

If the issued payee, amount, or check number don’t match up, it becomes an “exception.”

From there, you can review and determine if the check is valid, allowing the payment to go through, or if the check is invalid, in which case you can “return” it.

What is an ACH filter?

With an ACH filter, you can allow routine authorized debit transactions to pass-through your account hassle free.

However, when a new ACH debit hits your company’s account, the filter creates an “exception.”

When you need to review these “exception” items, a daily email is sent to you, instructing you to pay or return the flagged transactions.

Next Steps for Fraud Protection

Having these fraud protection services in place ensures your funds are protected and gives you convenient control over the items clearing your account.

If you’d like to see if Positive Pay or ACH filters are right for you, contact us by clicking the button below. A professional from our Treasury Management Team will be ready to answer any questions you may have.

Why Choose Waterford for your Fraud Protection and Business Banking?

Our Treasury Management Department works closely with clients to ensure their challenges are met efficiently. Offering single-source access, personalized service and time-saving products, we provide each of our clients with thorough, round-the-clock banking solutions that work when they do.

At Waterford Bank, customers enjoy a direct contact line to their bankers and treasury management professionals.

Unlike the bigger banks, Waterford gives clients a direct line of contact to a dedicated professional for all their treasury management needs, who is available to address concerns and answer questions promptly.

About the Author

Mary Pohlman is the Treasury Management Portfolio Manager Officer at Waterford Bank, N.A. in Toledo, Ohio. With over 14 years of experience, the last decade of which being dedicated solely to business clients, she is well-known for providing outstanding service to her customers and her vast knowledge of financial products. Want to connect? Contact us here.